Historical Trends and Future Projections: U.S. Federal Funds Rate from 1954 to 2025

Table of Contents

- Fed Rate Cut Projections 2024 - Eryn Odilia

- Fed Rate Cuts 2024 Schedule November - Carley Eolanda

- Fed Holds Rates Again. Expect Cuts in 2024 - NerdWallet

- Fed Rate Cut Projections 2024 - Eryn Odilia

- When Will Interest Rates Go Down?

- Fed Rate Cuts 2024 Dates January - Sada Wilona

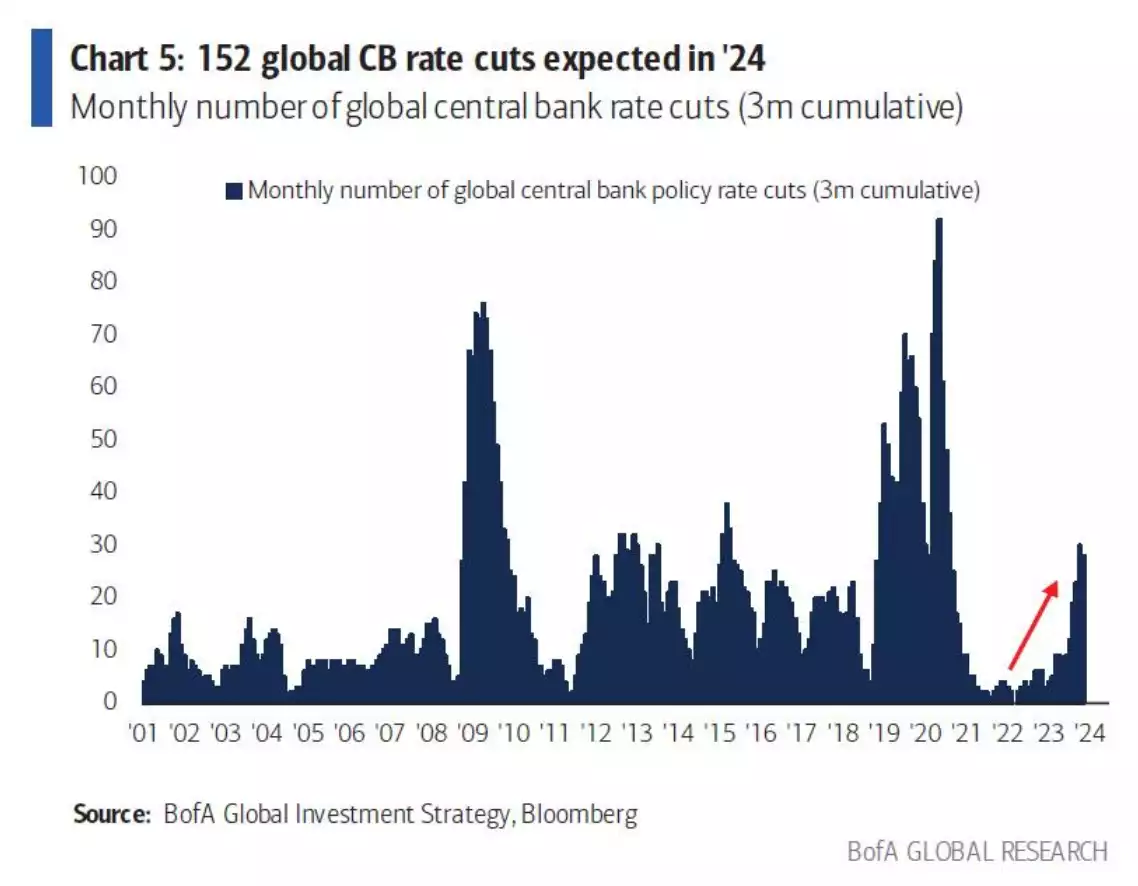

- “152 Rate Cuts in 2024” - Brace | Ainslie Bullion

- Fed Holds Rates Again. Expect Cuts in 2024 - NerdWallet

- Fed Interest Rate Cuts 2024 Uk - Tobey Pegeen

- Fed Rate Cuts 2024 Predictions Reddit 2024 Dates - Evvie Wallis

Historical Context: 1954-2020

Future Projections: 2020-2025

Implications and Impact

The U.S. federal funds rate has far-reaching implications for the economy, affecting: Borrowing costs: Higher federal funds rates increase borrowing costs for consumers and businesses, which can slow down economic growth. Consumer spending: Changes in the federal funds rate influence consumer spending, as higher rates can reduce disposable income and lower rates can increase spending power. Business investment: The federal funds rate affects business investment decisions, as higher rates can make borrowing more expensive and lower rates can stimulate investment. In conclusion, the U.S. federal funds rate has experienced significant fluctuations over the past six decades, and its future projections indicate a continued upward trend. Understanding the historical context and potential implications of the federal funds rate is crucial for investors, businesses, and policymakers. As the economy continues to evolve, it is essential to monitor the federal funds rate and its impact on the economy, to make informed decisions and navigate the complexities of the financial landscape.Source: Statista - U.S. federal funds rate from 1954 to 2025

Note: The article is based on data from Statista and is subject to change based on new data releases and updates.